March 6, 2020

Bank of Canada Rate Cut

What does it mean when the Bank of Canada drops their rates?

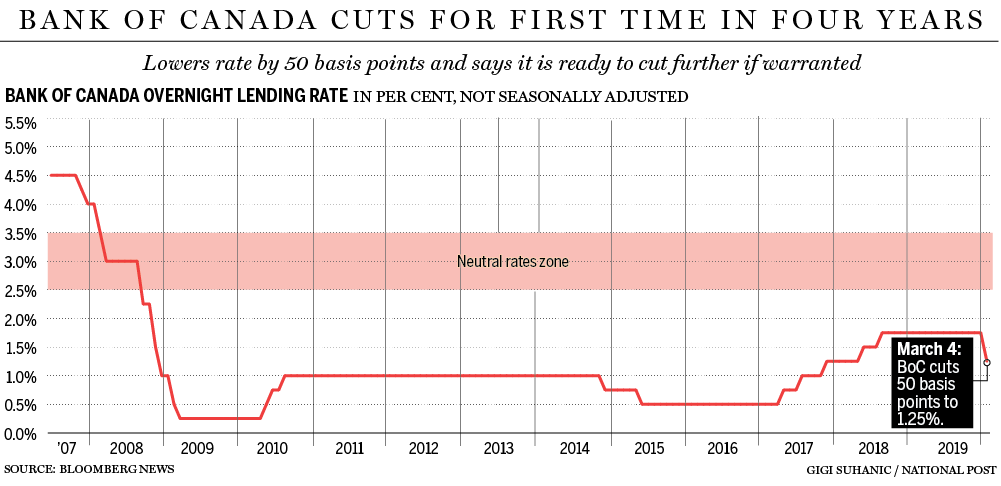

Wednesday morning, the Bank of Canada lowered its target for the overnight rate by 50 basis points to 1.25 percent from 1.75 percent.

Notable comments from the BoC:

- It is “becoming clear that the first quarter of 2020 will be weaker than the Bank had expected” when CPI inflation was “stronger than expected”

- While Canada’s economy has been operating close to potential with inflation on target, “the COVID-19 virus is a material negative shock to the Canadian and global outlooks”

Ignoring virus shock, domestic conditions have been less than favourable. The Bank notes that first-quarter growth will likely disappoint their prior 1.3% growth expectation and that business investment has not met recovery expectations in the wake of positive trade policy developments.

This is the first time the key interest rate has decreased since July 2015 and will have the greatest impact on those with Variable Rate Products:

- Variable Rate Mortgages

- HELOCs (Home Equity Lines Of Credit)

- Unsecured Lines Of Credit

Charter Banks were dropping their Prime Lending Rate [3.95% -> 3.45%] as recently as this Wednesday afternoon, and we expect the remainder of lenders to follow shortly.

Bond yields have also fallen sharply since the beginning of 2020, so we should see further pressure to decrease fixed rates as well.

The BoC “stands ready” to adjust monetary policy if required to support economic growth and keep inflation on target. As such, we cannot rule out further rate cuts next month.

We will continue to monitor economic and financial conditions, future announcements by the BoC, and the impact this may have on your mortgage(s). We would love to hear back from you if you have any questions or feedback regarding anything outlined above.

Thanks again for your continued support and referrals!