April 11, 2024

BoC Meeting Result: Where are we at?

Square in the eye of the storm.

They say it’s a calm place where not much happens. And while that may ring true to some extent, calm is hardly the adjective I would use. While we have battled through the first wave of the storm (read: inflation and rate hikes), we have now been free of rate hikes for the last six Bank of Canada (BoC) meetings. And in this ‘lull,’ most of us eagerly await the other side. But calm? No. Unease. Uncertainty. Fear. That’s what this eye of the storm has looked like for most of us.

We're all trying to read between the lines of the BoC messaging to make some sort of attempt at prediction. But at this stage of the game, even they aren’t committed to a particular path. Whether we see a rate cut in June will depend entirely on how the next couple of months of data unfolds. The data has been encouraging, and if that trend continues, the likelihood of a June or July rate cut will look pretty strong. And what’s more encouraging was to hear BoC Governor Tiff Macklem tell us that a June rate cut is in the realm of possibility.

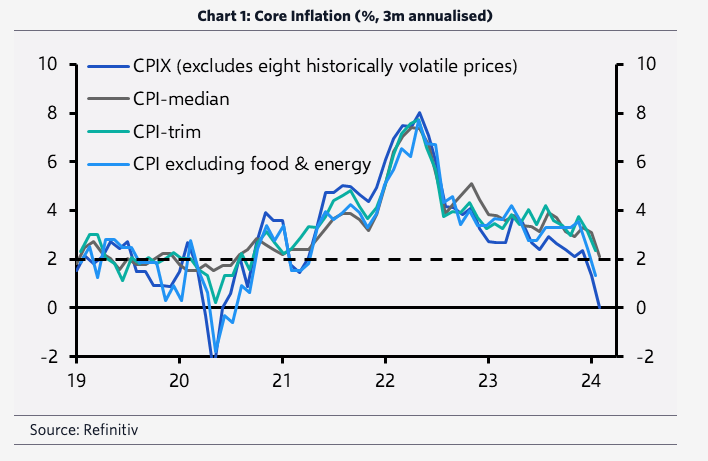

The key ingredient to seeing some interest rate relief is the downward momentum of inflation being sustained. Over the last couple of months, we have seen some big changes on that front. The core inflation metrics that the BoC monitors closely have been trending to the 2% target over the last 3 months (see graph). The old CPIX metric that the previous BoC regime used, well it’s down to 0% if we annualize the last 3 months. We no longer need to see inflation easing - we just need to see the current trend sustained.

But as in any analysis, there are risks that can throw it off course. And right now, the two things that threaten potential rate cuts are the strength of the US economy and the recent rise in oil prices. The Americans are much less fazed by higher interest rates because of lower debt loads and much longer term mortgages. They are likely further from rate cuts than we are, and any gap between US and Canadian policy rates impacts the Canadian dollar. And with the concerns in the Middle East, Russia’s ongoing invasion of Ukraine and OPEC cutting supply, oil prices are on the rise. That increase has the potential to stop inflation from marching towards target levels.

If you’re looking forward to rate cuts and relief, there is a lot to like about the way Canada’s economy is unfolding. The next moves are clearly going to be downward. It’s now just a matter of timing. And I think this is where a lot of us struggle right now. If I were to ask you what your expectations were for 3 years from now, a healthy majority would likely be pretty optimistic. Interest rates will be lower. Housing prices will be higher. And the economy will be performing better. But if I ask you what things will look like in 3 months? Yeeeeaaahhhh…did your cortisol levels just spike? From the eye of the storm, it’s really hard to look through what ‘might’ be coming in the short term in favour of a longer term view. The fear and uncertainty paralyze decision making. But like the Buddhists say, this, too, shall pass.

Fortunately or unfortunately, we humans are hard-wired to worry about the short term. It’s what has kept us safe and allowed our species to develop. But decisions made for the short term often come with a very high price tag (see that last Friday night, you partook a little too much). I joked today with a client (what’s up, Mike?!) that much of my job over the last 20 or so months has been interest rate therapy. Helping people see beyond the short term swings to take a longer term view. It’s better for our peace of mind and, quite often, our wallets. So, if you’re struggling to decide what to do, please reach out. I’m more than happy to help.

All the best out there!