July 13, 2022

Not 'The Big One' we expected....BoC rate jumps by 1%

Uncle Tiff measures 2.5% on the rate scale...

Hit Me One(%) More Time

Did any one else feel the earth tremble this morning? Or was it just me? That was not 'The Big One' we have been expecting on the coast. But it's the one we got. This morning's move by the Bank of Canada (BoC) to raise their overnight rate by 1% comes as a bit of a surprise. The expectations were for a 0.75% increase so why the larger move?

The "Why"

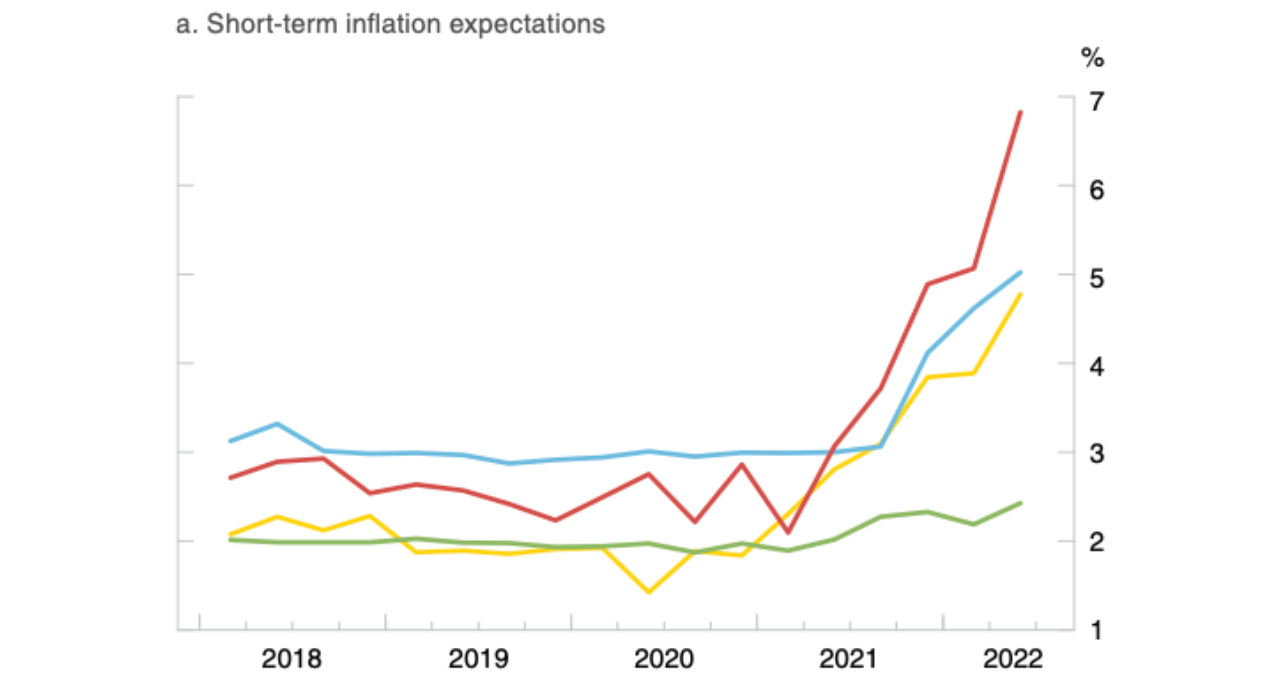

There is a graph (copied below) in today's Monetary Policy Report (MPR) that I feel explains today's higher-than-expected jump in rate. What's measured on this graph are the expectations of inflation over the coming years among Canadian Consumer and Business owners.

- The Red line is what consumers think inflation will be in 1 year

- The Blue line is what consumers think inflation will be in 2 years

- The Yellow line is what businesses think inflation will be in 2 years

- The Green line is what economists think inflation will be in 2 years

The data for this graph was published July 4th, 2022. And what it shows is that consumers and businesses expect inflation to be much, much higher than it should be. And this is a huge problem for a Central Bank. Why? Because it creates a cycle goes like this:

- People expect things to be more expensive

- People demand a higher wage to cover the higher expense of living

- Businesses pay the higher wage but have to increase their prices to cover costs

- Prices rise and then we start back at point 1 and keep on going...

Most of what the Bank of Canada is battling right now are these expectations. Economists don't seem too stressed about inflation. But consumers and businesses are. Big time. And if the BoC doesn't act now and people continue to think inflation is a problem, they'll have to go ever higher on their policy rate to deal with the issue down the road. And so today - we get a 1% hike in what is a very strong attempt to beat those expectations into submission.

Rates go up > spending goes down > supply matches demand > inflation stabilizes

The "How"

This one is going to be what's on the mind of most borrowers: "How did we get here?!"

There is a section at the end of today's MPR that I have dubbed the "Oopsy Report". It accounts for a number of different issues that caused forecasts to be so far off. Some of the standout culprits included there are:

- Oil and Commodity prices (accounting for 40% of forecasting errors)

- Russia's invasion of the Ukraine a huge factor here

- Severe weather events affecting agricultural commodities

- Goods demand went off the charts. There was a major shift in buying patterns during the pandemic towards goods and low-contact services where some softness in demand was expected

- Hands up if your 2021 Amazon billings were higher than normal...

- Supply simply couldn't keep up with demand

- Overall, a much faster than expected recovery in Canada

- Government interventions at the start of the pandemic had a much stronger impact in helping turn things around than expected

- There were multiple references in the MPR around "Global" factors accounting for 60%+ of current inflation numbers. And unfortunately, all the BoC controls is what happens within our borders.

The "What"

"Well that's all well and good, Ray, but what do we do with this information?!"

The BoC demonstrated today that they're committed to their job of bringing inflation down into the target range. And it won't be without it's short-term pains. But that pain won't last forever. Fundamentally, Canada is still in a very strong position and we're now ahead of the rest of the developed world in tightening things up which will serve us well.

From where I sit, there are 3 options for mortgage borrowers right now that aren't already in a fixed rate:

- Convert to a fixed rate mortgage

- Upside: you'll know what your rate and payment are going to be going forward and can jump off the emotional roller coaster

- Downside: the fixed rate market is potentially near it's height for the short-medium term. As the likelihood of a recession increases, the probability of fixed rates rising further decreases. And if we hit a recession, fixed rates will drop

- Stay the variable course

- Upside: they're still ~1% cheaper than fixed rates currently, provide more flexibility and will move the right way (down) if we enter into a recession and stimulus is required

- Downside: it's rather stressful trying to guess what the market is doing and watching your payment increase and having to adjust

- Refinance/Make Adjustments to ease payment stress

- Upside: there's a good chance you have some flexibility in your mortgage to extend the amortization or move to a product with a capped payment or roll in additional debt payments to free up cash flow

- Downside: there's always costs associated with this be it lender penalties and/or legal/notary fees for registration

If you are unclear on your options or would like to run through specific details for your mortgage, please don't hesitate to reach out. We'll be more than happy to present you with any scenarios or guidance that help ease your mind and solve any problems.

And as always, if you know anyone that could benefit from this information, please pass it on! There will be no shortage of headlines out there today. So please reach out if you need to chat through some thoughts!