December 22, 2023

What Rate Trends Will 2024 Bring?

Final Newsletter of 2023...it's a gooder too!

So how about that 2023...? It was a doozy. I can already tell you with a high degree of certainty that I will gather my grandchildren and tell them stories that are grossly exaggerated for dramatic effect about this year.

And while I want to avoid a "Year In Review" style Newsletter that would spike my stress levels and trigger some PTSD - I found myself curious about the trends over the course of this year. Where did we start? How are we ending? And how do those trends inform what we might expect in the months and year ahead?

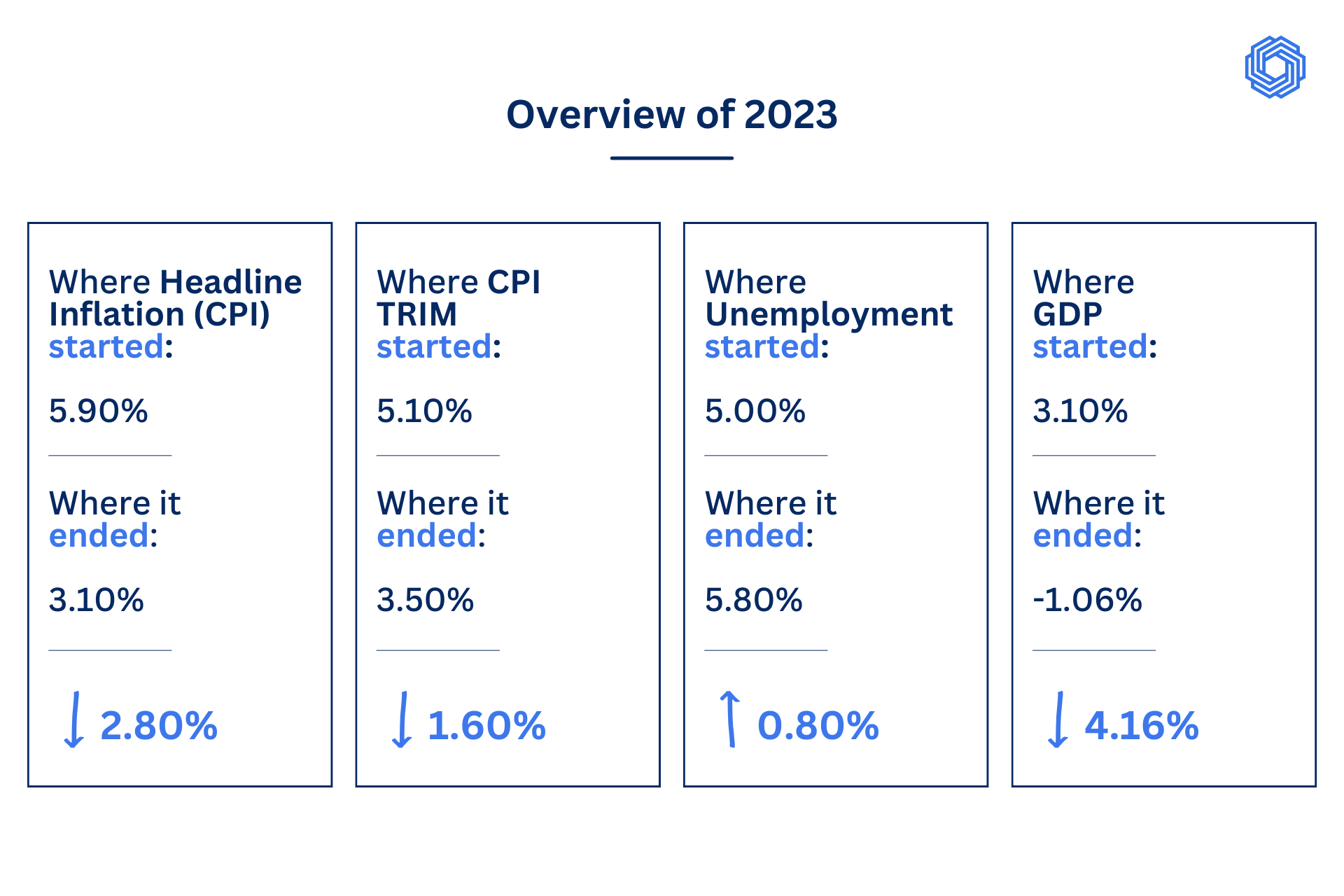

I've highlighted some key metrics over the course of this year that the Bank of Canada (BoC) pay particularly close attention to. And as you can see from the data above - all of them are trending in the "right" direction for us to start seeing some interest rate relief on the horizon. And what's critically important to note here is these very apparent trends are only going to get worse in the months ahead of us. Interest rates are still well into restrictive territory. On top of that, $186B in mortgages in 2024 and $315B in 2025 will be renewing into these restrictive rates putting more stress on the budgets of Canadians.

Tiff Macklem, Governor of the BoC has said explicitly that they will not need to wait for inflation to hit that 2% target before easing the policy rate. It's very likely they are concerned about these mortgage renewals and the impact it will have on household budgets. More money being spent on mortgage payments means less to spend on goods and services. And less money being spent in the economy means lower growth, higher unemployment and downward pressure on inflation.

Relief Is On The Way!!!

Don't believe me? Totally fair. I think we all have a healthy amount of skepticism given the events of the last two years. And though nobody really knows when rate cuts will start and how deep the cuts will go, those in charge of making the decisions are beginning to get more vocal. As of Wednesday, the chair of the Fed (The US version of the BoC) Jerome Powell acknowledged the risk of holding rates too high for too long (article here). Fed officials also acknowledged that not only are they likely done hiking rates but they foresee three, quarter point cuts to their policy rate in 2024 (a 0.75% reduction).

Central Banks historically haven't been great at recognizing that they've gone too far in hiking rates. And though part of that is probably deliberate (a recession is more desirable to Central Bankers than persistent high inflation), another part of it is not seeing or believing the signs soon enough. In Canada, those signs have been made murky by other factors out of their control. Pandemic fuelled savings. Historically high population growth that strained supply chains. Federal Government spending. And so on.

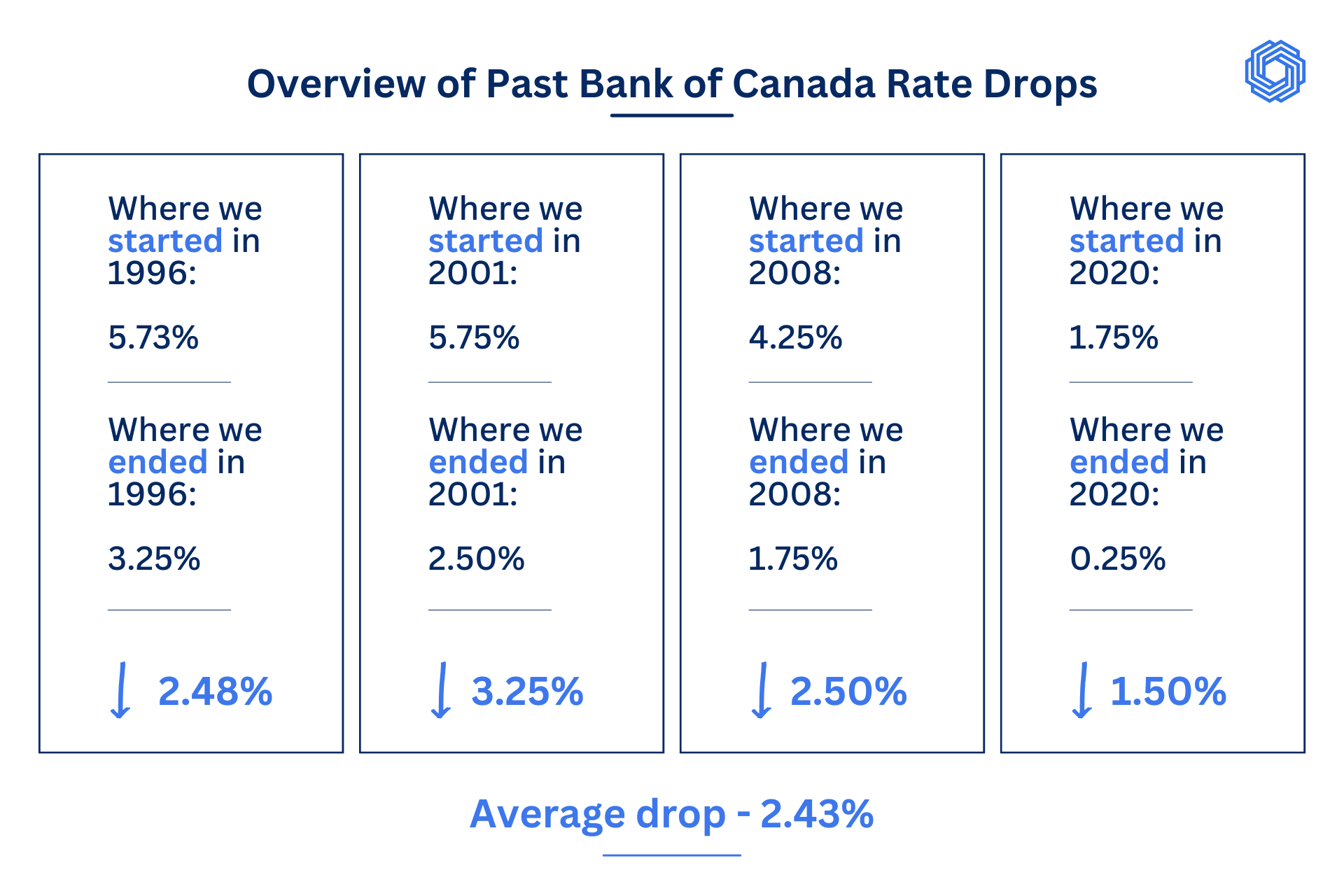

But take a look at the most recent four rate cutting cycles by the Bank of Canada. Kinda pokes a hole in the 'rates higher for longer' camps claims, no? As I'm typing this out, "The Market" expects the BoC to cut rates by 1% in 2024 with the first move likely coming in March but priced fully in by April. Based what the experts are forecasting, that 1% cut looks somewhat conservative. Some predictions for you from the talking heads:

- TD Economics: 1.5% cut by the BoC in 2024. Cuts beginning in April.

- CIBC World Markets: 1.5% cut by the BoC in 2024. Cuts begin in May or June.

- Capital Economics: 2% cut by the BoC in 2024. Cuts beginning in March.

At this point, it would take something overly dramatic to change the expectations around the next move by the BoC being a cut. And if history is our guide, its very likely that we're underestimating how deep and how quickly rates will have to be eased to prevent some seriously negative economic outcomes. At a minimum, the BoC is likely to have to move rates out of restrictive territory (5% currently) and back into neutral territory (estimated at 2%-3%). It's unlikely they will be able to go much lower than the high end of neutral as population growth is still fuelling consumption and lower rates will accelerate the housing market. But a 2% drop in Prime? Yes. Please. For the love of all things holy.

What To Do

If even a portion of what I've laid out is accurate, then variable rates will make a big comeback in popularity. I recently did a poll on Instagram that confirms this as 65% of respondents indicated they would take a variable rate mortgage over a fixed if they had to choose today. And that's science! The thing is, fixed rates are slow to come down. Since the beginning of October, 5 year bond yields have dropped more than 1%! But 5 year fixed rate mortgages? Well they've only fallen by 0.35% to 0.5%.

I've even had clients reach out to see if it made financial sense to break their fixed rate mortgage from last year for a small penalty to jump into a variable rate mortgage. The short answer is it certainly can but there are obvious risks there as well.

The bottom line is that whatever situation you're in, it's important that we connect. If you're thinking about buying or have a mortgage renewing soon, getting good advice around strategy will be critical to saving you money. Please reach out, set up a time to connect and I'll be happy to help out. And if you know anybody that could benefit from our services, referrals are always appreciated.

Well that about does it for 2023. Enjoy the holidays with your loved ones. I will be around if you have any questions at all!