November 28, 2023

A look into my crystal ball and what to expect

Is now a good time to buy? Let me tell you....

I get asked to predict the future on the regular. Where things are going. Whether now is a good time to buy. What rate and term are the best to take. And so on. And though like anyone else, I really don't know what's going to happen going forward, I still have some pretty strong opinions that use data and trends to support them. So if you find yourself wondering - wonder no more. Here is my opinion:

We have FINALLY hit the point where we can confidently say that rates have peaked. Bank of Canada (BoC) Governor Tiff Macklem stated last week:

"...interest rates may now be restrictive enough to get us back to price stability"

That statement alone is massive given how it lies in stark contrast with the much more aggressive tone we've been seeing since the spring. But with inflation dropping more significantly than expected, growth in the economy flatlining and dipping into negative territory, and an unemployment rate that is increasing at a rate consistent with recession, there really is no reason for rates to rise further. Add to all of this bounty of mortgages yet to renew into higher rates (estimated $251B in 2024 and $352B in 2025) that have the potential to add further stress and strain to an already struggling economy and we now have the basis for markets to look forward to rates being cut.

And that's exactly what markets are doing. If you want to know where fixed rates are heading, watch Canadian Government bond yields. As I'm typing this, the 5 year bond yield has dropped by 0.73% in the last two months. Meanwhile the 2 year bond yield has dropped by 0.57% over a similar time frame. What this means is we'll see some downward pressure on fixed rates. We're already starting to see mortgage rates cut but not by nearly the same magnitude that bond yields have dropped. Rates are very quick to rise but slower to come down. As this pressure continues, lenders will be forced to adjust as they vie for market share and loan originations.

Something I have mentioned before but bears repeating: fixed rates anticipate. These markets are trying to predict the next move by the BoC. And though they aren't so good at predicting the timing and magnitude of those changes - they are rarely wrong about the direction. And what they're predicting next is a downward move of the Overnight Rate between April and July of next year. What we're likely to see between now and then is a continued easing of fixed rates in anticipation of that cut. Fixed rates move first.

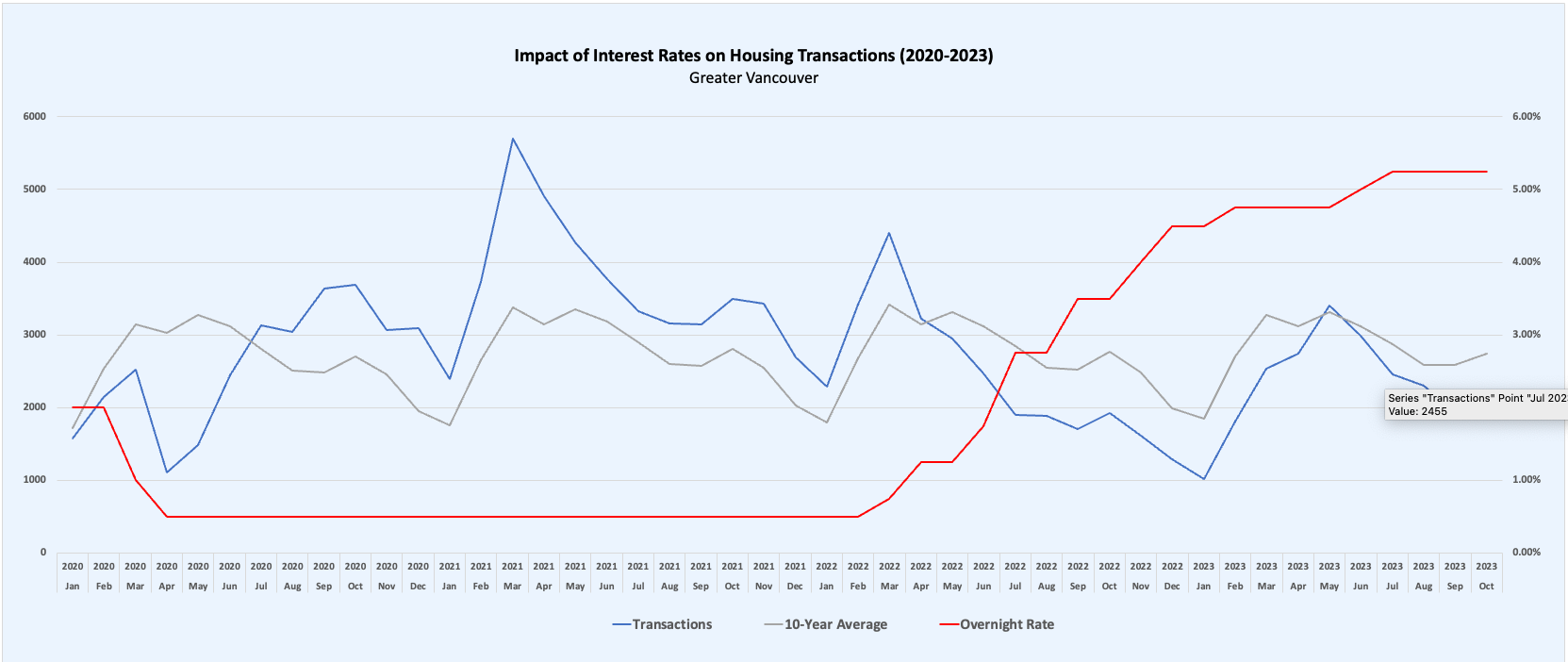

And when rates move, it impacts the housing market. Both the number of transactions and prices are heavily impacted by interest rates. To illustrate just how much, we did up a graph (kudos to Helen!) below that charts the number of Real Estate Transactions monthly and how that's been affected by the changes in the BoC policy rate. For some added context and comparison, the average monthly transactions for the last 10 years are charted as a baseline measure.

Some pretty clear trends emerge here. Low rates led to a higher than normal transaction count. Higher rates put the brakes on home buying and selling. The peaks in transactions also tend to line up with a "Spring Market" (save for the obvious exception during the pandemic emergence in 2020).

So what should we expect going forward? The answer: regression to the mean. Which is just a fancy way of saying that these lower transaction counts should begin to move towards long term averages. Rates will start to decline. Heck - they already are. As confidence grows in the first rate cut by the BoC draws near, activity will start to pick up. Consider the amount of population growth Canada has experienced. And yet - Real Estate transactions have...dropped...? We are very likely sitting on a lot of pent up demand that will find it's way off the sidelines very soon.

Many potential buyers have felt squeezed out or just straight up stressed out of the housing market as a result of the higher rates and the uncertainty it's created. If you find yourself in that camp, now is a great time to revisit your options. Get yourself pre-approved, know your numbers and get your questions answered. We are happy to help you out here. So if that sounds like you or someone you know, don't hesitate to reach out and connect with us.

All the best out there,

Key Dates Upcoming:

- November 30th: 3rd Quarter GDP

- Not much is expected here for GDP numbers - Q3 is expected to coming in at -0.1% after Q2's -0.2%.

- December 1st: Labour Force Survey November 2023

- Canada's unemployment rate his ticked up by 0.7% over the last 6 months. Hard to imagine this trend doing anything other than getting worse for now.

- December 6th: Bank of Canada Interest Rate Announcment

- Covered aggressively above - expect a pause and perhaps even a softening of the language that has been very strong up until recently